YuLife’s inventive new group critical illness cover is set to shake up the South African insurance industry this quarter. Co-founded in London by South African actuary Jaco Oosthuizen in 2016, the insurtech’s gamified approach to wellness has radically changed the way employees interact with their insurance products.

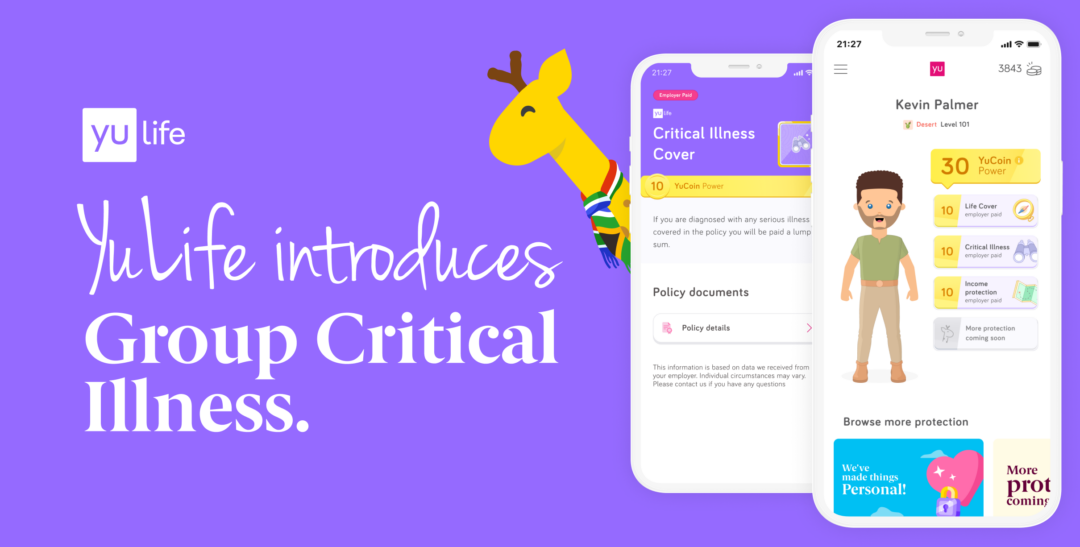

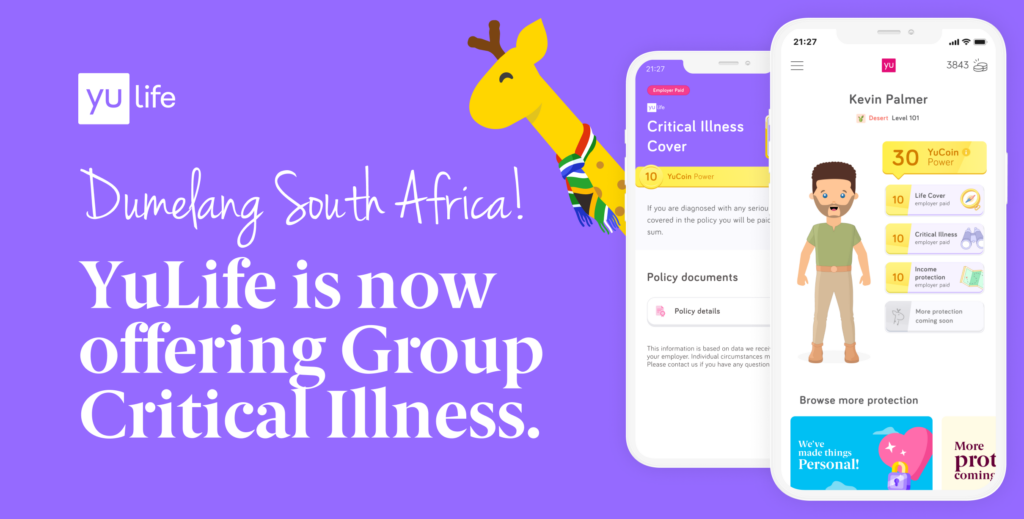

The launch of YuLife’s group critical illness cover in the South African market, is the latest addition to its product offering having previously piloted its Group Risk Protection.

Its suite now includes life insurance, income protection, lump sum disability, funeral cover and group critical illness cover and its aims are lofty. YuLife wants nothing less than to help South African employers protect their employees, inspire them to live well and reward them for doing so. Through an app that has harnessed the addictive qualities of a genre of popular mobile games and used it to promote wellness, YuLife seems to be doing just that.

Closing The Gap:

The average South African income earner has a disability cover gap of at least R1.4 million, meaning that, for millions, the loss of a single income earner could throw their family into financial peril. Widening access to critical illness cover is therefore a pressing need for South Africa’s insurance industry. YuLife’s groundbreaking approach to insurance ensures that businesses can offer financial security for their teams while incentivising employees to bolster their mental and physical wellbeing. This, in turn, increases productivity and puts both employers and employees on a more stable footing.

YuLife’s critical illness cover pays a lump sum if an employee suffers an illness or injury defined in their policy. Alongside these typical components of a critical illness policy, YuLife also includes an internationally acclaimed wellbeing app that integrates trusted support services. By harnessing the latest trends in behavioural science and game mechanics, the YuLife app encourages employees to make proactive lifestyle changes, while also prioritising prevention by de-risking individuals through healthy activities.

The YuLife app enables employees to complete everyday wellness activities, such as walking, meditation, and cycling, to earn YuCoin, YuLife’s virtual well-being currency. Members can then use their YuCoin to buy vouchers for groceries, data, fuel, clothing and more from leading brands. They can also use their currency to make a difference in the world by donating meals, planting trees, or cleaning the ocean. Additionally, all employees with YuLife get access to virtual GP services through Kena Health, counselling and advice through ICAS and access to multiple wellbeing apps like Meditopia and Fiit.

“Since our launch in South Africa, we have been inspired to see such widespread and intense interest in a new model of insurance which prioritises risk prevention and promotes a positive relationship between policyholder and insurer,” said Oosthuizen, who is also the Managing Director of YuLife South Africa. “By launching YuLife’s critical illness cover, we are helping to fill a long-standing gap in the market, supporting employers in providing a vital extra layer of financial security for their employees. We look forward to witnessing the transformative impact that expanded access to critical illness cover will have on South African society as a whole.”